New York State Itemized Deductions 2025 Calendar – You can claim itemized deductions on your New York tax return You are not claiming New York state’s noncustodial parent earned income tax credit. New York’s earned income credit is equal . Stay updated on the standard deduction amounts for 2025, how it works and when to claim it. Aimed at individual filers and tax preparers. .

New York State Itemized Deductions 2025 Calendar

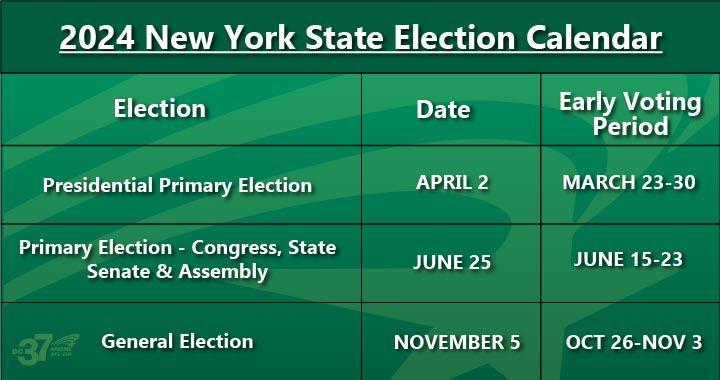

Source : www.hrblock.comJanuary 2025: Union News, Events and Services | Local 375 AFSCME

Source : www.civilservicetechnicalguild.orgComments on New York City’s Executive Budget for Fiscal Year 2025

Source : comptroller.nyc.govNew York Paid Family Leave Updates for 2025 | Paid Family Leave

Source : paidfamilyleave.ny.govState income tax Wikipedia

Source : en.wikipedia.org2025 IRS Tax Brackets and Standard Deductions Optima Tax Relief

Source : optimataxrelief.com2025 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgPayroll Tax Rates (2025 Guide) – Forbes Advisor

Source : www.forbes.comAnnual Summary Contracts Report for the City of New York : Office

Source : comptroller.nyc.govProjected 2025 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.comNew York State Itemized Deductions 2025 Calendar Tax Calculator: Income Tax Return & Refund Estimator 2023 2025 : Well, it’s that time of the year again. That W2 is calling your name to be filed. With the season underway, experts recommend getting it done as soon as . With tax season underway, you’ll need to know the standard deduction amount you can claim for 2023. The standard deduction amounts tend to increase slightly each year to adjust for inflation. Let’s .